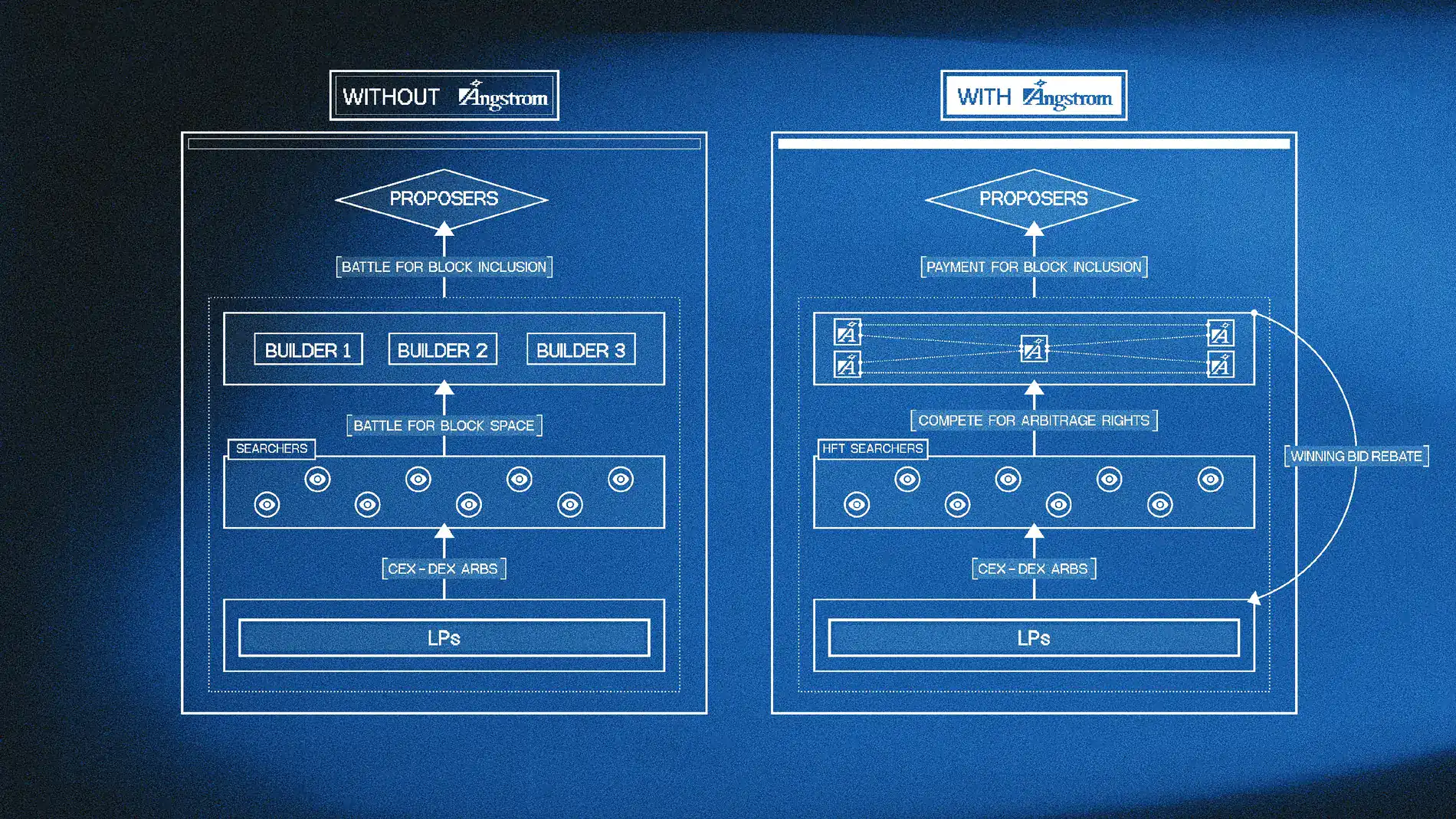

Arbitrage Auction

Angstrom runs an arbitrage auction at the start of every block to recapture the typical CEX-DEX arbitrage profits that usually flow to external searchers or block builders. Here, arbitrageurs bid for the right to execute rebalancing trades fee-free.

How It Works

- Bidding: Potential arbitrageurs submit bids indicating how much they’re willing to pay for exclusive access to the pool’s liquidity.

- Selection: The highest bidder wins and executes trades without pool fees, realigning the price to match centralized markets (CEX).

- Payment to LPs: The bidder’s payment is distributed directly to LPs in proportion to their active liquidity. This recovers the value that would otherwise be extracted by external MEV searchers & builders / proposers.

Why It Matters

- LP Sustainability: Traditional AMMs leak LVR (Loss Versus Rebalancing) value to arbitrageurs. By holding an open, permissionless auction, Angstrom gives all would-be arbitrageurs a chance to bid for these profits, pushing final payment back to LPs.

- No Block Builder Bribes: Because the DEX itself decides transaction ordering (see App-Specific Sequencing), participants no longer have to bribe block builders for top-of-block positioning, this value is instead captured by LPs.

- Democratized MEV Competition: Rather than trading firms competing as block builders, bidding for entire blocks to secure their arbitrage trades, Angstrom breaks this winner-takes-all system into individual pool auctions. This lowers barriers to entry and drives competitive bidding—traders can now target specific opportunities without needing the capital and infrastructure to arbitrage the entire market. More competition leads directly to higher bids, returning more value to liquidity providers.

Tying It Together

After the arbitrage auction runs and the pool is updated to the correct price, Angstrom transitions to the Batch Auction phase for user orders. This two-stage process ensures both LPs and swappers are protected from typical MEV losses.